philadelphia property tax rate 2022

Philadelphia County Pennsylvania has a typical property tax rate of 1236 per year for a home with a median value of 135200 and a median value of 135200. Consultation of Philadelphia Property Tax Records.

States With Highest And Lowest Sales Tax Rates

The last time most property owners saw changes to their.

. May 9 2022. Buy sell or rent a property. Just call 215 686-6442 and ask about our Real Estate Tax relief.

Taxing districts include Philadelphia county governments and various special districts such as public hospitals. The average home sales price in Philadelphia went from more than 267000 in 2019 to nearly 311000 as of January according to the multiple listing service Bright MLS. Please note that the.

Residential Property Assessments for Tax Year 2023. May 03 2022 As Philly braces for property value reassessments Kenney proposes wage tax reduction and other relief The real estate boom has increased the aggregate value of residential properties. 1 be equal and uniform 2 be based on current market value 3 have one appraised value and 4 be deemed taxable unless specially exempted.

If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. Taxation of properties must. For the 2022 tax year the rates are.

If you are a resident of Philadelphia who receives certain types of unearned income such as royalties rental income this tax applies to you. The Kenney administration said those changes which resulted in hefty tax hikes for many. As the first citywide reassessment in three years the increases to.

Help is also available to veterans. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the Federal income tax. Get help with deed or mortgage fraud.

Tax rate for nonresidents who work in Philadelphia. Tax Year 2022 assessments will be certified by OPA by March 31 2021. Philadelphia County collects on average 091 of a propertys assessed fair market value as property tax.

Nonresidents who work in Philadelphia pay a local income tax of 350 which is 043 lower than the local income tax paid by residents. The reassessment of Philadelphias 580000 properties is expected to generate 92 million in additional property revenue for the city with the value of the average residential property up 31 from the last assessment. The citys Office of Property Assessment OPA will release new citywide property assessments for fiscal year 2023 later this spring.

Look Up an Address in Your County Today. Property reassessments for the majority of Philadelphia homeowners are back after a two-year hiatus during which home values have spiked. Yearly median tax in Philadelphia County.

Get home improvement help. 1 How to Search Consult Print Download and Pay the Philadelphia Property Tax. This app maps how much assessments changed for the more than 400000 single-family residential properties in the city.

Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000. If you disagree with your property assessment you can file an appeal with the Board of Revision of Taxes BRT. Search for Philadelphia Property Taxes.

The new tax plan would keep the property tax rate the same. Our Installment program is also helping seniors and low-income families pay their bills in monthly installments. Get information about property ownership value and physical characteristics.

Theyre a revenue pillar for public services used to maintain cities schools and special districts including water treatment plants public safety services transportation and more. The new rate will apply to all applicable unearned income received in Tax Year 2022 January through December 2022. Proper notice of any levy increase is also a requirement.

Request a circular-free property decal. 091 of home value. The citys property tax rate is 13998 of the assessed property value.

Philadelphia determines tax rates all within the states regulatory rules. On May 9 2022 the City of Philadelphia released updated assessed values for all properties in the city. What does this have to do with property taxes.

The City calculates your taxes using these numbers but can change both the Homestead Exemption amount and the tax rate. Access the City of Philadelphia Government Website. Report a problem with a building lot or street.

Bills reflecting those assessments will be issued in December of 2021 for taxes due in March of 2022. Lawmakers are still hammering out the details to offset the proposed rates. Pennsylvania is ranked 1120th of the 3143 counties in the United States.

As of July 1 2022 the rate for residents will be 379 previously 38398. Property owners have seen their taxes rise dramatically in concert with home prices over the last three years. The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200.

The citys revaluation that took effect in 2019 saw a 105 increase in the median assessed value for a single-family home. Based on the current tax rate for every 10000 in increased value your yearly tax bill will go up by 140. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as assessed by the Office of Property Assessment OPA.

The property tax rate in Philadelphia is. Submit a service request with 311. There are three vital stages in taxing real estate ie devising tax rates estimating property market values and collecting receipts.

Then receipts are distributed to these taxing authorities according to a predetermined plan. The wage tax rate is set to drop from 384 to 379 for city workers and the median annual household income for Philadelphia is about 49k. Philadelphia property tax rate 2022 Friday March 18 2022 Edit.

Property Tax Invoice Philadelphia. Tax Year 2022 assessments will be certified by OPA by March 31 2021. Average property taxes in 2020.

Ad Request Full and Updated Property Records. Philadelphia PA 19105. Philadelphia released new assessments of property values which they will use to calculate 2023 property tax bills.

But you must act fast as March 31 is also the deadline to apply for the 2022 Real Estate Installment Plan. Get Reliable Tax Records for Any Local County Property. Track a service request with 311.

Get help paying your utility bills. That increased by an additional 31 for the last reassessment which was completed in 2019 and used for 2020 and 2021 tax bills. If your assessed value went up your property taxes will too.

5919 up 94 Philadelphia is in the midst of making some of the biggest changes in years to the citys taxes. Only property owners whose values change will receive notifications. Property taxes are the cornerstone of local community budgets.

The city skipped reassessing property tax values for fiscal year 2021 and 2022 over concerns about the accuracy of how it valued property and pandemic-related issues.

Corporate Taxes By State In 2022 Balancing Everything

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Internet Sales Taxes Tax Foundation

How High Are Capital Gains Taxes In Your State Tax Foundation

The States With The Highest Capital Gains Tax Rates The Motley Fool

Cell Phone Tax Wireless Taxes Fees Tax Foundation

Median United States Property Taxes Statistics By State States With The Best Worst Real Estate Tax Rates

Pennsylvania Property Tax H R Block

2022 Property Taxes By State Report Propertyshark

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

Property Tax How To Calculate Local Considerations

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)

How To Reduce Your Property Tax Bill In Philadelphia

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

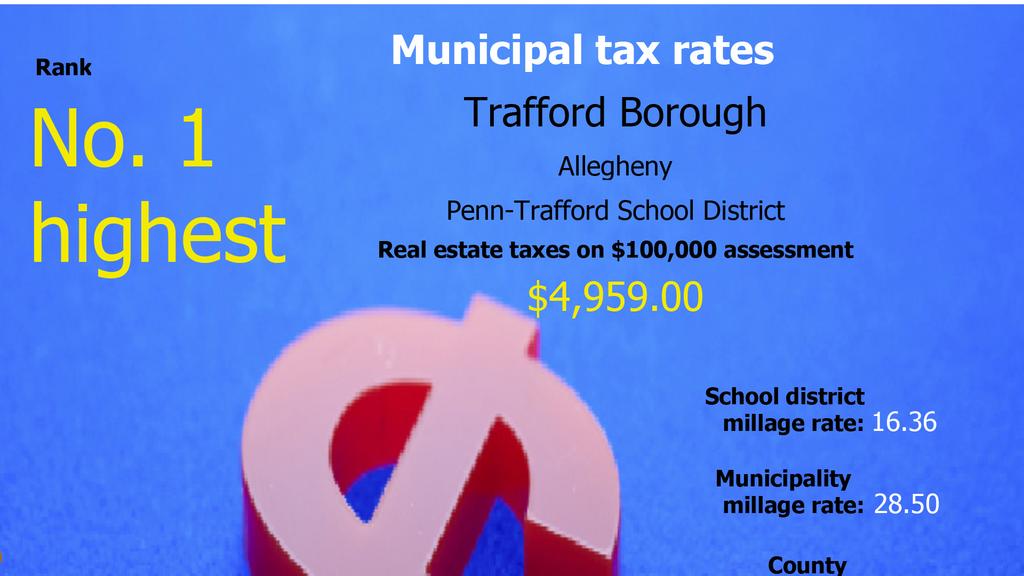

Allegheny County Real Estate Tax Rates Compared Pittsburgh Business Times

Philadelphia Releases New Property Tax Amounts Estimate Your New Tax Bill Here

Pennsylvania Property Tax Calculator Smartasset

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Iowa Reduces Corporate Individual Income Tax Rates Grant Thornton